Bullionstar

January 28, 2021

https://www.bullionstar.com/blogs/ronan-manly/dawn-of-bitcoin-price-discovery-2009-2011-the-very-early-bitcoin-exchanges/

With the rapid growth of Bitcoin and the proliferation of cryptocurrency exchanges, it’s easy to forget that a mere 12 years ago, there were no trading markets for Bitcoin and no market established Bitcoin prices.

In fact, following the mining of the first Bitcoin block on 3 January 2009 by the eponymous Bitcoin creator Satoshi Nakamoto, it would be another 9 months until the first known Bitcoin price was recorded on 5 October 2009.

Some common themes among the early Bitcoin exchanges were that they were operated more or less as one man outfits, they quoted extremely low Bitcoin prices, the exchanges had limited interest even among the Bitcoin hobbyists, and the exchanges were prone to attacks from hackers and fraudulent activity.

New Liberty Standard (NLS)

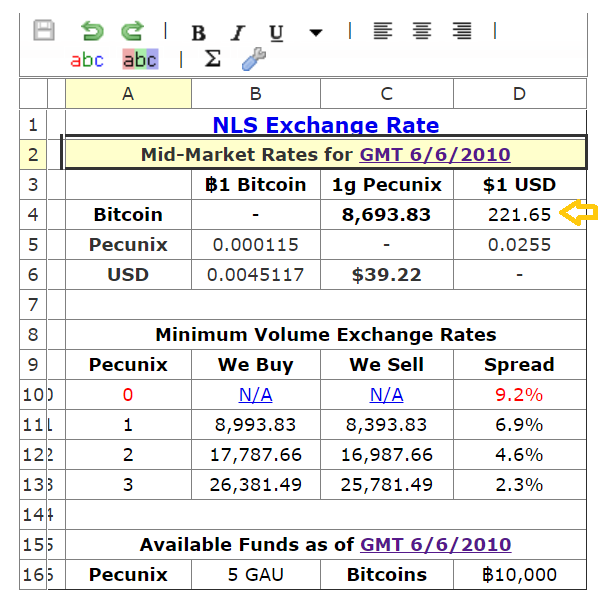

The first known Bitcoin price, or exchange rate, recorded on 5 October 2009 was published on what was the world’s first Bitcoin exchange site, New Liberty Standard (NLS), a site which offered a service to buy and sell Bitcoins in exchange for US dollars using PayPal. The site was operated by “NewLibertyStandard”, who was a frequent contributor to the early Bitcoin forum Bitcointalk.org, and who discussed his exchange site on the forum in posts such as here.

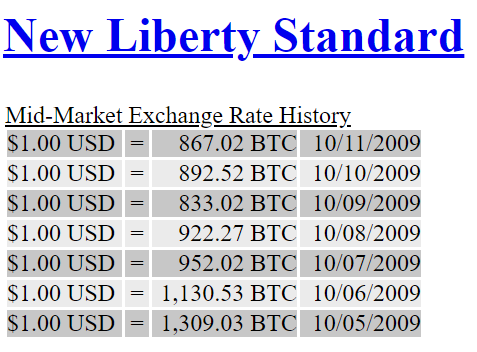

The very first Bitcoin / USD exchange rate published on the New Liberty Standard site on 5 on October 2009 was USD $1.00 = 1,309.03 BTC, which equated to an incredible $0.00764 per Bitcoin, or in other words 7.6 US cents per 100 Bitcoins.

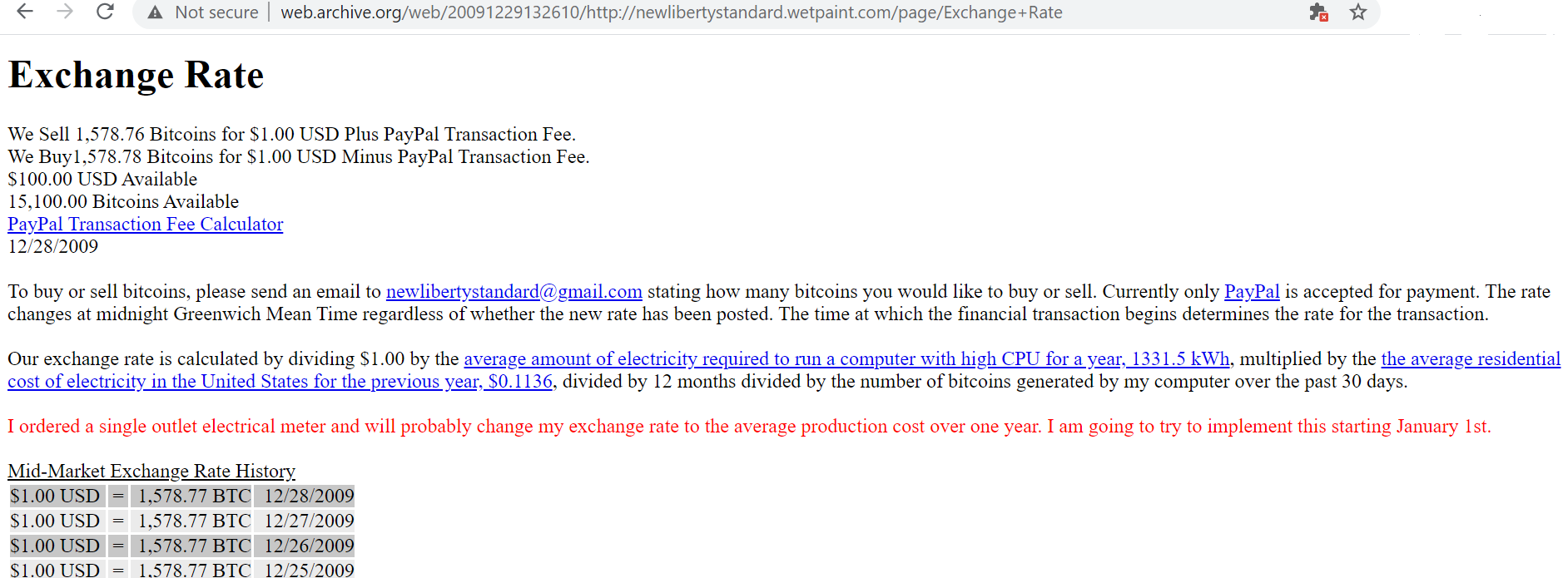

NewLibertyStandard calculated this exchange rate using a formula based on:

“dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided, by the number of bitcoins generated by my computer over the past 30 days.”

As you can see, this Bitcoin price in the early days was determined not by buying and selling activity of Bitcoins, but by the price of electricity and the site owner’s personal Bitcoin mining output. The calculation became a bit more complicated in early 2010 using rolling averages and the addition of broadband internet costs, and can be seen in another archive imprint from the New Liberty Standard site in late April 2010 here.

A list of the daily USD / Bitcoin prices between 5 October and 28 December 2009 can be seen on a 29 December 2009 Wayback Machine (Archive.org) imprint of the New Liberty Standard exchange rate page here. If the Wayback Machine page is slow to load, these historic exchange prices can also be seen on NewLibertyStandard’s webpage here.

The best rate quoted for buying Bitcoins on the NLS exchange in 2009 was on 17 December 2009 when you could buy an incredible 1630.33 BTC for US $1.00.

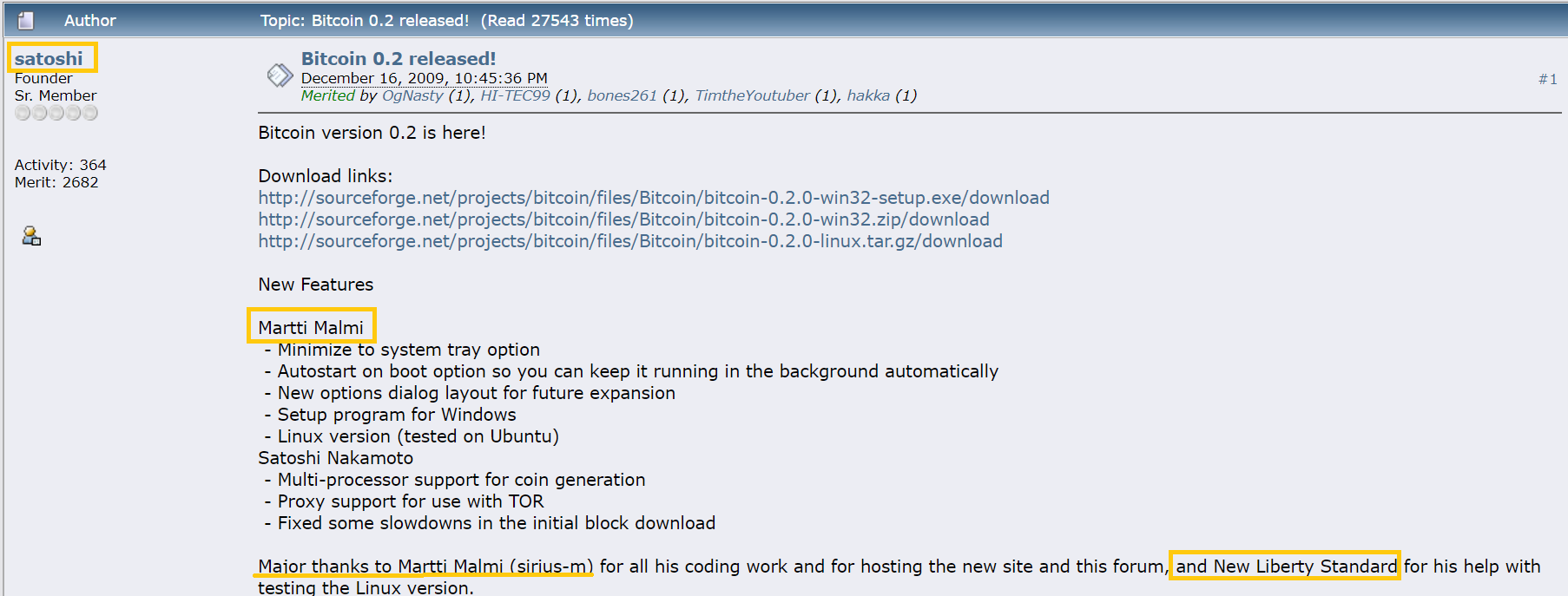

NewLibertyStandard was also known to Satoshi Nakamoto, as for example, Satoshi thanked NewLibertyStandard on 16 December 2009 for helping to test Bitcoin 0.2 (see Bitcointalk discussion topic here).

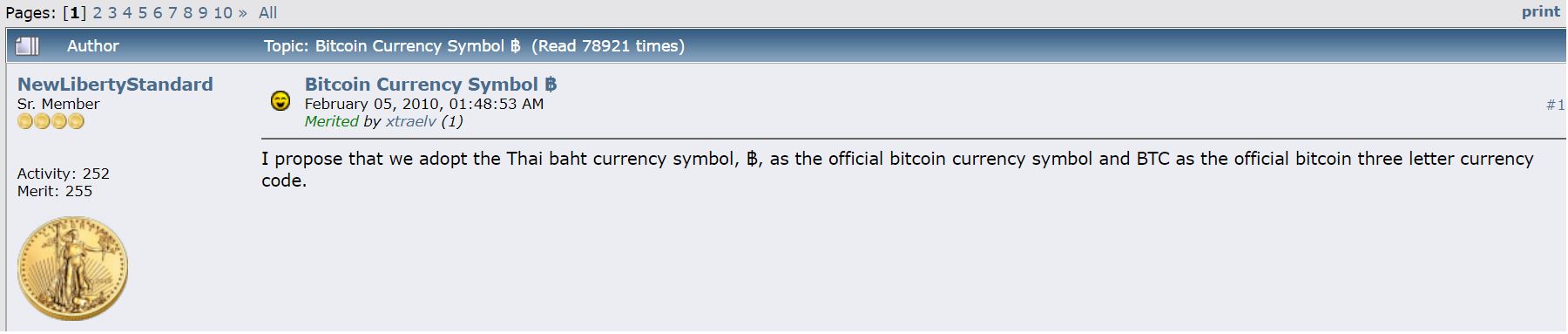

Interestingly, it was NewLibertyStandard who came up with the Bitcoin symbol ฿ and the Bitcoin ticker BTC, when on 5 February 2010 he posted on the Bitcointalk.org forum that:

“I propose that we adopt the Thai baht currency symbol, ฿, as the official bitcoin currency symbol and BTC as the official bitcoin three letter currency code.”

In early October 2009, there was also an historic Bitcoin / USD transaction which consisted of a Finnish programmer and early Bitcoin supporter named Martti Malmi selling 5050 BTC to NewLibertyStandard for US$ 5.02, which was the equivalent of 9.94 US cents per 100 Bitcoins.

This transaction is confirmed by a Tweet on Martti Malmi’s Twitter account as below

This transaction was, as Malmi explains below, to help support the Bitcoin trading service of New Liberty Standard.

Malmi also interestingly went on to launch his own Bitcoin for fiat currency exchange service for a time in 2010, which he called bitcoinexchange.com. Although there are no Archive.org imprints of this site, Malmi (who went by the name Sirius in the Bitcointalk,org forum) discusses it in January 2010 here, and also mentioned it last month (December 2020) in a Tweet below:

Not only was Martti Malmi known to Satoshi, but be also helped Satoshi code and test Bitcoin 0.2, as can be seen from this Bitcointalk posting on 16 December 2009 here.

By 19 January 2010, the New Liberty Standard exchange was seeing a small volume of business, as attested by the site owner NewLibertyStandard in a post on Bitcointalk.org:

“I have had people buy bitcoins from me and sell bitcoins to me. Supply and demand, albeit only a small amount, already exists and is all that is really needed. Offering to exchange bitcoins for another currency is ultimately no different from exchanging bitcoins for goods or services.”

On his website, NewLibertyStandard descried Bitcoin as an “economic revolution”, saying that “Bitcoin is the gold standard of digital currency. The availability of bitcoins cannot be manipulated by governments or financial institutions and bitcoin transactions occur directly between two parties without a middleman.”

Bitcoin Market (BCM)

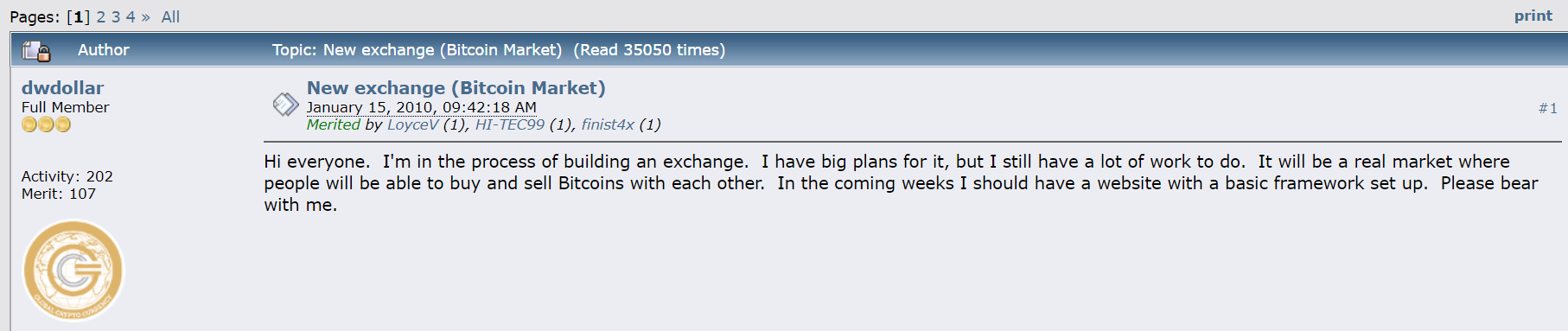

The second pioneering initiative to create a price for Bitcoin also came from someone who became a well-known contributor to the Bitcointalk.org forum. This was a Bitcoin exchange site called Bitcoin Market (www.bitcoinmarket.com), created in early 2010 by Bitcointalk’s ‘dwdollar’, whose real name ironically is Dustin Dollar.

The very first post of ‘dwdollar’ on Bitcointalk.org was to announce his plans to create a Bitcoin exchange, when he posted on 15 January 2010:

“Hi everyone. I’m in the process of building an exchange. I have big plans for it, but I still have a lot of work to do. It will be a real market where people will be able to buy and sell Bitcoins with each other. In the coming weeks I should have a website with a basic framework set up. Please bear with me.”

Again on 6 February 2010 in an update he added that:

“I am trying to create a market where Bitcoins are treated as a commodity. People will be able to trade Bitcoins for dollars and speculate on the value. In theory, this will establish a real-time exchange rate so we will all have a clue what the current value of a Bitcoin is, compared to a dollar. I have an early version up at http://98.168.168.27:8080/”

‘dwdollar’ was adamant that the exchange should reflect real trading between market participants and not the production costs of Bitcoin:

“Unless there is a way to determine demand, no one will be using them as a currency. Even now, every Bitcoin has a value. The key is finding it and tracking it.

I want this to be a real market where buyers and sellers determine the value based on their demand. It will match buyers and sellers (it can already do that) accordingly. I will only be a broker. I don’t think we should be worried about what the value is.

Our main concern should be accurately determining that value as it fluctuates…. The fact we are worrying about people dumping Bitcoins suggests we haven’t determined an accurate value yet."

The Bitcoin Market (a.k.a. BCM) site went live in March 2010 and used PayPal for cash handling (also adding Pecunix gold grammes (GAU) and Liberty Reserve (USD) at later dates). On 16 March 2010, dwdollar posted on the Bitcointalk.org forum saying that he had:

“created an account and placed a bid for 500 Bitcoins @ $.0067/BC which I think is NewLibertyStandard’s current exchange rate.”

This 16 March 2010 rate of $0.0067 per coin, which was 67 cents for 100 coins, was 8.77 times more than the NewLibertyStandard’s starting price that had been specified on 5 October 2009, less than 6 months earlier.

On 17March 2010 (St Patrick’s Day), dwdollar posted another message that:

“There are 9 people signed up but only 3 have made a deposit so far. Myself makes 4. Looks like we had our first real trade around noon!”

Interestingly, a few days later on 20 March 2010, there was a reply to dwdollar’s post on the Bitcointalk.org forum from the now famous (in the cryptocurrency world) Jon Matonis, who said:

“Hi, very exciting news about the momentum building for Bitcoin. I just posted a summary on my economics blog, “The Monetary Future", which can be found at http://themonetaryfuture.blogspot.com/2010/03/bitcoin-peer-to-peer-electronic-cash.html

The blog focuses on digital online exchangers and anonymous digital currencies penetrating the market so that we may all protect our financial privacy. Should be interesting and entertaining for many on this forum.”

Bitcoin Market in its ‘About page" claimed that “it was the first to offer a free-floating exchange rate and an escrow trading system.” It incorporated as Bitcoin Market LLC in September 2010. A new site Bitcoin Market site was rolled out in October 2010 with Dustin Dollar (a.k.a dwdollar) as the “developer of the Bitcoin Market website and owner of Bitcoin Market LLC.”

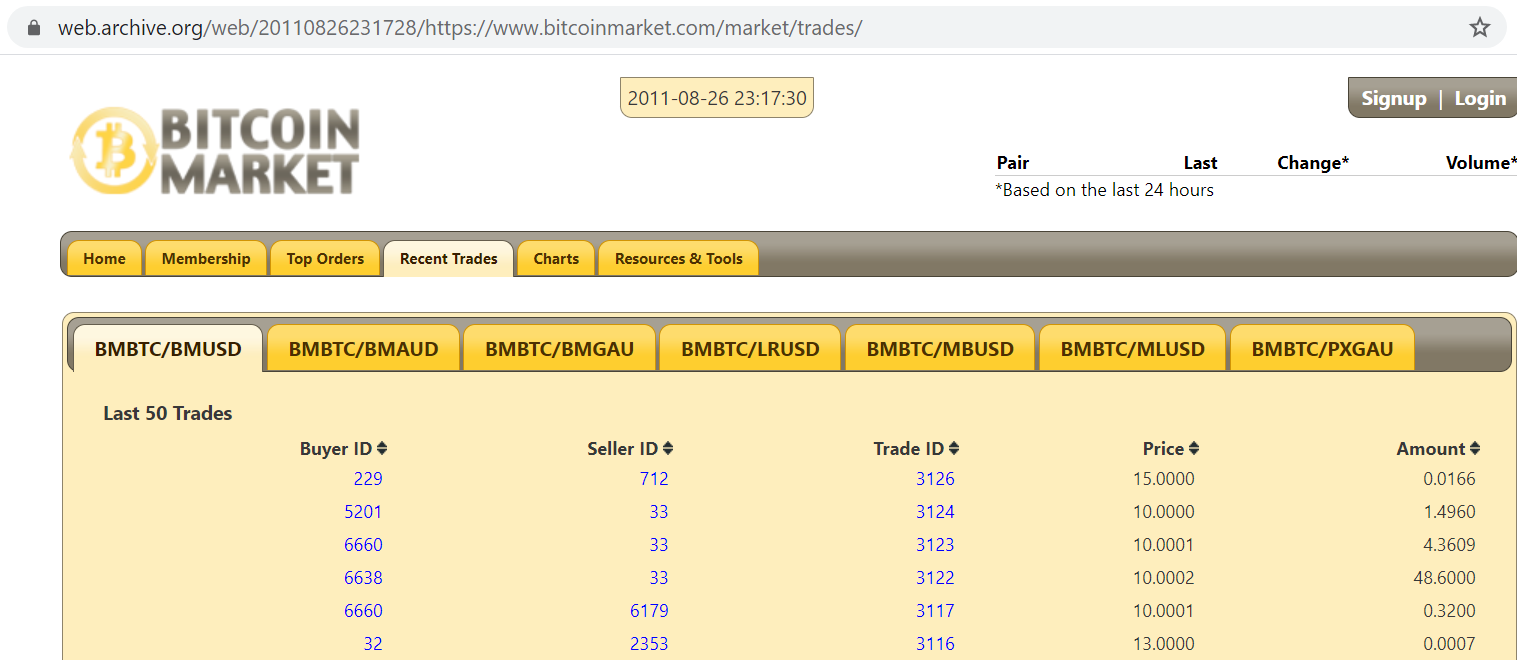

The earliest captured imprint of the site via the Wayback Machine is September 2011 and can be seen here. Some Bitcoin Market trades (from 26 August 2011) can be seen on an archived page here, where prices by then had reached the range of $10 – $17 per Bitcoin.

Mt. Gox

Following the launch of Bitcoin Market in March 2010, the next major development for Bitcoin Exchanges came a few months later with the launch of the now famous (and infamous) Mt. Gox on 18 July 2010, which described itself as an exchange that “allows you to trade US Dollars (USD) for Bitcoins (BTC) or Bitcoins for US Dollars with other Mt Gox users. You set the price you want to buy or sell your BTC for.”

Launched by Jed McCaleb, the exchange and website name is an abbreviation of a previous site of McCaleb’s called “Magic: The Gathering Online”, hence the name Mt Gox. McCaleb would later reach fame as the co-founder and CTO of Ripple, and the co-founder of Stellar (where he is also currently CTO).

McCaleb announced the launch of his exchange on, you guessed it, the Bitcointalk.org forum, in a short post here, where he said:

“Hi Everyone,

I just put up a new bitcoin exchange.

Please let me know what you think.

https://mtgox.com“

The prices on Mt Gox were basically in the form of last traded price, High, Low and volume (over 24 hours), as well as Current Lowest Buy and Current Highest Sell Prices offered by exchange users. According to the Mt Gox homepage, “all trades are between users. So the current buy price and current low price is just what someone else entered.”

An early website imprint of the Mt. Gox home page from 3 February 2011 can be seen here.

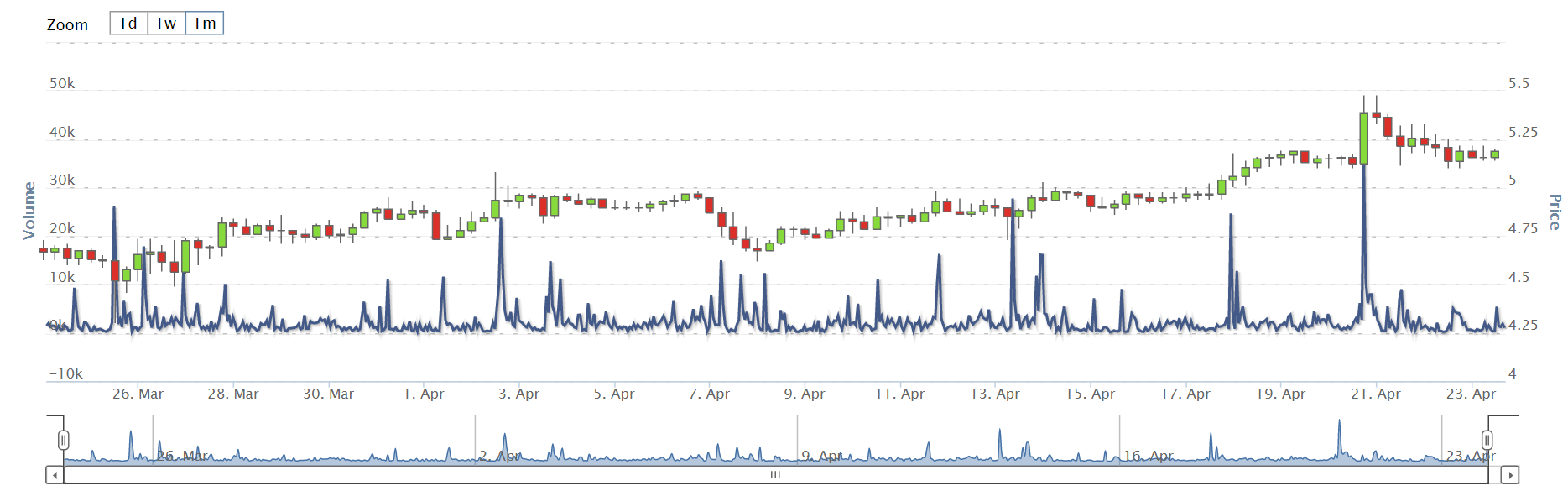

An archive imprint of a page from website Bitcoin Charts (bitcoincharts.com) on 19 November 2010 shows Bitcoin prices in US dollars for both Bitcoin Market and Mt Gox, with the BTC price in US dollars in a range from $ 0.23 to $0.28 per Bitcoin.

There was even technical analysis of the Bitcoin price on the Mt Gox site from as early as November 2010, with user ‘S3052’ (who was also active on Bitcointalk.org) posting daily updates, such as on 6 December 2010. In hindsight, these Bitcoin prices look miniscule now and practically unbelievable:

“Overall, the decline is continuing. Unless 0.3 – 0.35 $ are taken out substantially, the trend is DOWN. A strong target remains 0.1 – 0.14 $.

Analysis

1. Long term outlook: BTC/USD have broken the long-term trendline (now around 0.23 $ and slowly rising) to the downside. Support lies in the 0.11-0.14 $ area. As long as prices find support there, there is “light in the end of the tunnel”, meaning an end of the decline with continued rally.

2. Short term update “A break down below 0.20 would deteriorate the technical picture heavily and open the door for fast declines”. We have breached the 0.20 level with a low of 0.185 $ today, so unless prices move back above 0.20 and more importantly, the trendline quickly, a sell off towards ultimately 0.1 $ is quite probable. As you can see in the volume picture, huge buying volume came in between 0.09 and 0.10 $, which makes this a likely strong support level.

Less than a month later, Bitcoin prices had rallied nearly 500% as a range of prices on the Mt. Gox ‘Buy Bitcoins’ page (3 January 2011) were in the range of US$ 0.93 to US $ 0.955 per Bitcoin.

In March 2011, Jed McCaleb sold the Mt. Gox Bitcoin exchange to Mark Karpelès (who went by the name MagicalTux on Bitcointalk.org). The sale was announced on the Bitcointalk.org forum on 6 March 2011 by user mtgox (Jed McCaleb) where he posted:

“Hello Everyone

I created mtgox on a lark after reading about bitcoins last summer. It has been interesting and fun to do. I’m still very confident that bitcoins have a bright future. But to really make mtgox what it has the potential to be would require more time than I have right now. So I’ve decided to pass the torch to someone better able to take the site to the next level.

MagicalTux has already contributed a lot to the bitcoin community and in many ways he will be better at running the site than I was.

…Thanks to everyone that has supported mtgox so far. Can’t wait to see BTC hit $10! “

Interestingly, Mark Karpelès became one of the founding member of the Bitcoin Foundation when it was established on 23 July 2012, along with such names as Roger Ver, Gavin Andresen and of course Satoshi Nakamoto.

Following the sale, Karpelès, who had moved from France to Japan in 2009, moved the Mt Gox operation to the Shibuya business district in Tokyo and structured Mt. Gox as part of his Japanese company Tibanne Co Ltd. A revamped Mt. Gox website was launched on 1 December 2011. See press release here.

By that time, Mt Gox described itself as “facilitating the exchange of Bitcoins between users globally in the currency of their choice. Multiple currency markets allow users to purchase and resell their Bitcoins in up to 16 different currencies, along with the ability to securely store Bitcoins in a virtual “vault” for safe keeping”

The revamped Mt. Gox website from late 2011 can be seen here in a Wayback machine archive imprint from 11 January 2012, where the prices at that time were – Last price: $6.849. High: $7.138. Low: $6.500. Volume: 100,958 BTC, Weighted Avg Price:$6.84563

The rest, as they say is history. For anyone not aware of what happened to Mt. Gox, it filed for bankruptcy on 28 February 2014, citing insolvency and seeking protection from creditors, announcing that it had lost approximately 850,000 Bitcoins. This comprised 750,000 Bitcoins belonging to clients and 100,000 Bitcoins belonging to Mt. Gox. Mt Gox claimed it had been hacked and the Bitcoins stolen.

According to the Wall Street Journal as cited by the LA Times:

‘“There was some weakness in the system, and the bitcoins have disappeared. I apologize for causing trouble,” said Mt. Gox Chief Executive Mark Karpeles at a news conference in Tokyo.’

A few weeks later, Mt Gox said that it ‘found’ 200,000 Bitcoins after it was pointed out by blockchain watchers that these coins were still moving among Mt Gox BTC addresses. For a good recap about Mt Gox at the time see a March 2014 article from Wired here.

According to the Japan Times, a US task force investigating Mt Gox traced the bulk of the 600,000 hacked Bitcoins to a Russian programmer called Alexander Vinnik and arrested him in Greece in 2017 for “allegedly laundering funds From hack Of Mt. Gox”. Vinnik had been the co-founder of an early Russian Bitcoin exchange in 2011 called BTC-e (old site here). Not to be confused with another early Russian Bitcoin exchange (also started in 2011) called BTCex (old site here).

Conclusion

Looking back on the pioneering Bitcoin exchanges, its hard to believe that it was less than 12 years ago. In some ways, these early Bitcoin exchanges of New Liberty Standard, Bitcoin Market, and Mt. Gox even look like they are from a bygone era. It wasn’t that the technology didn’t exist in 2009 – 2011 to create robust, sophisticated and secure Bitcoin exchanges. Its just that there was no institutional interest and investment to do so.

Hence, the pioneering exchanges were launched by a smattering of interested individuals who were enthusiastic and active in the Bitcoin space at that time. Its striking also that the main players in this drama all knew each other in one way or other, that they believed in sound money that cannot be inflated, and that many of them are still major figures in the cryptocurrency world.

While the prices established for Bitcoin during those times, from 1500 BTC for a $1 in October 2009 to even 1 BTC for $1 in February 2011, are historically interesting, maybe the more lasting contribution of these early exchanges is that they paved the way for the massive and ever accelerating crypto ecosystem which has been built on their foundations.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.